This week, the retail analyst firm IHL Group released a new report, “Are We There Yet? How Computer Vision Will Shape the Future of Retail,” which examines the state of computer vision adoption, plans, and impact within “retail environments with high-volume, front-end checkouts such as Grocery, Drug, Mass Merchants, Convenience Stores, and larger Specialty Hard Goods retailers like DIY, Electronics, and others.”

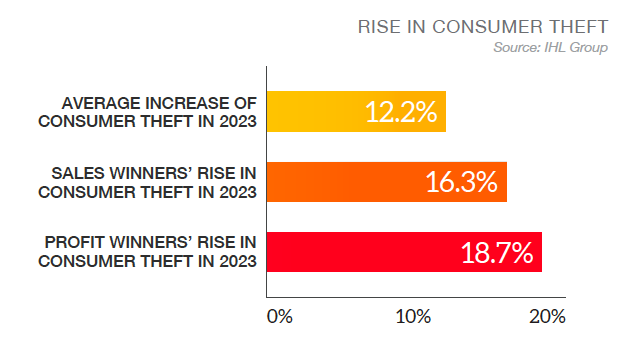

Last year, IHL estimated that theft resulted in $379 billion in shrink, part of a $1.77 trillion (that’s trillion with a T!) “inventory distortion” issue. In this latest report, IHL points to a 12.2% average increase in consumer theft in 2023. What’s more, sales and profit winners actually experience HIGHER percentages of theft than their less successful peers, as shown in the graph below.

Battling imperatives: Shrink reduction and customer experience

Alongside the pressing issue of shrink, retailers are struggling to improve customer experience and increase customer loyalty in a dynamic retail market that has been rapidly shifting first due to the dramatic rise of online shopping, which accelerated even further due to the pandemic.

Yet, these two issues of reducing shrink and improving the customer experience are often in direct conflict as strategies that reduce shrink can negatively impact the customer experience, leading to further lost revenue.

The rise of computer vision in retail

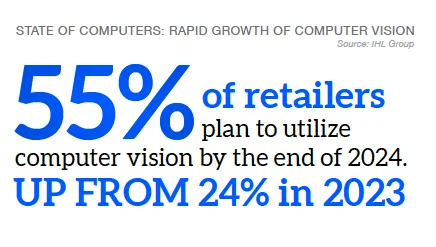

Enter computer vision. Unlike many retail solutions that target one problem or the other, computer vision has the potential to positively impact both challenges simultaneously. In IHL’s just-released study, we’re seeing early evidence of computer vision becoming a cornerstone of new retail strategies and technological advancements. IHL’s study reports that 55% of retailers will be using computer vision by the end of 2024, a dramatic increase from the 24% that have some form of computer vision in place today.

Computer vision by itself, however, is simply a tool. As part of retail solutions, however, computer vision can help reinvent self-checkout, enable scalable cashierless, grab-and-go deployment, or improve on-shelf availability and inventory management.

The IHL study bears this premise out by analyzing the correlations between current and planned computer vision deployment and the adoption of other technologies.

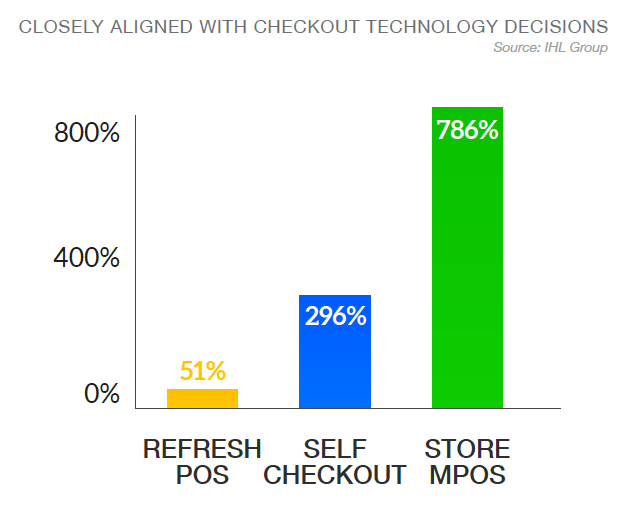

For example, changes in checkout are heavily correlated with the adoption of computer vision.

According to the report:

- Those making Refreshing their POS a priority in 2024 are 51% more likely to be already using computer vision and 320% more likely to be making a new computer vision decision in 2024.

- Those making a new Self-checkout decision in 2024 are 296% more likely to be up to date on computer vision and are 102% more likely to be making a new computer vision decision in 2024.

- Those using store mPOS today are 786% more likely to be using computer vision already and those making a new store mPOS decision in 2024 are 616% more likely to be making a new computer vision decision in 2024.

Similarly, 31% of all companies are up to date with frictionless Amazon Go-type technology, and another 31% seek to update/deploy it in the next two years. In contrast, 34% of companies planning to make a new decision on computer vision are up to date with Amazon Go-type technology, and an additional 56% plan to do so in the next two years.

However, that pent up demand comes with its challenges. As we’ve outlined in our blog posts on technical computer vision challenges and the operational challenges of deploying computer vision in retail, the potential of computer vision can be thwarted due to the relative immaturity of some of the computer vision technology in the market. Historic, and in fact most current, computer vision solutions require such precise conditions to work that they’ve largely been ineffective at achieving their potential in real-world environments, despite significant investments in time, resources, and R&D.

In coming weeks, we’ll be exploring the challenges of computer vision and the questions retailers need to ask before betting on the technology.

In the meantime, there’s a lot more to explore in IHL’s report, and we hope you have the chance to take a read through it.